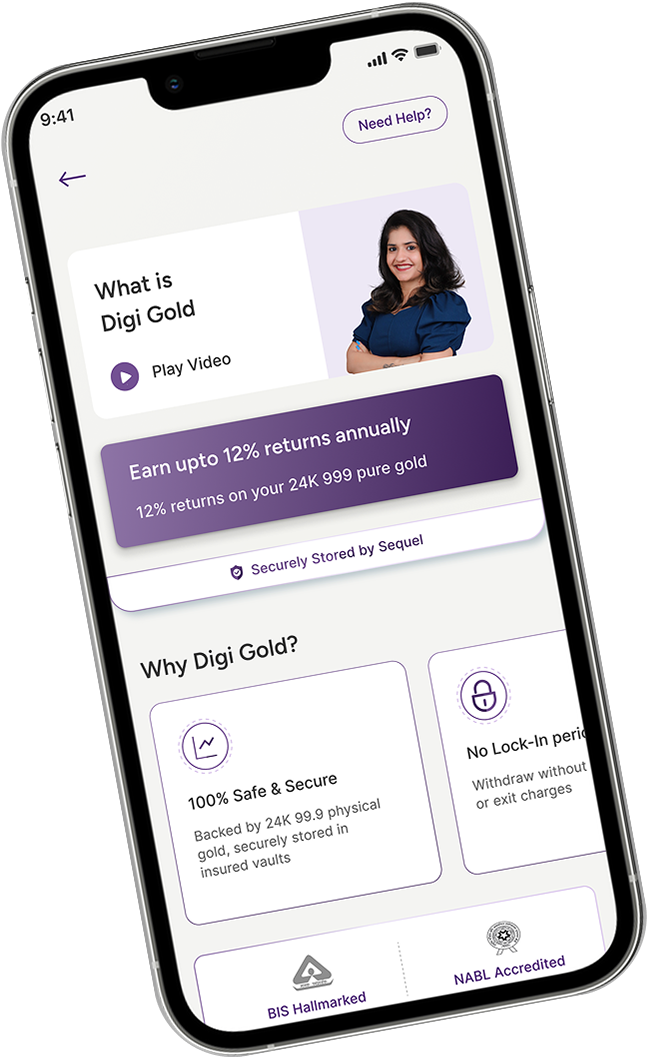

Earn up to 12% annual returns (That’s 3X more than a typical FD)

Backed by 100% physical gold, securely stored in insured vaults

No lock-in. No exit charges. Redeem to your bank anytime

Start investing in Digi Gold with just ₹100

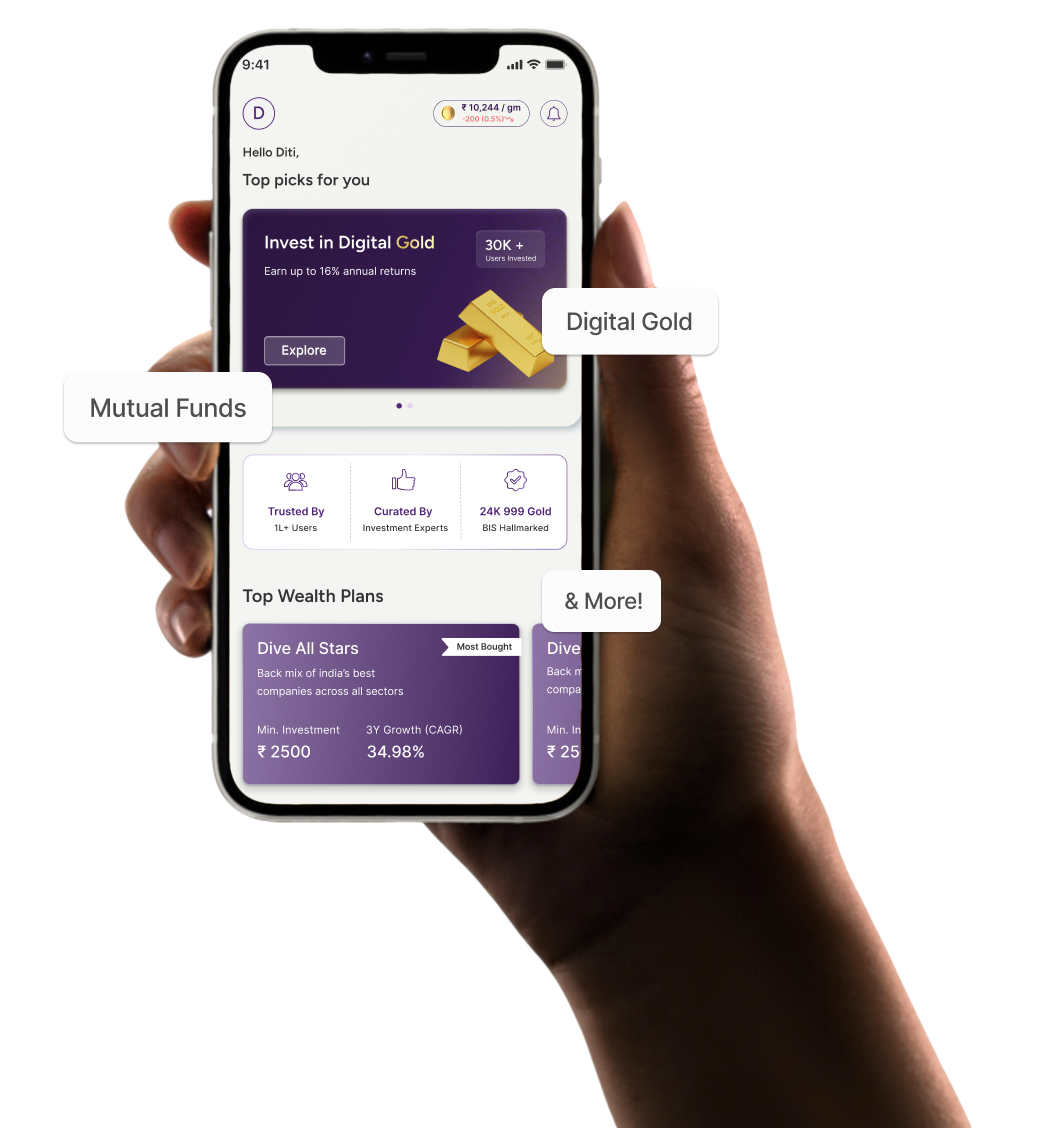

Earn up to 16% annual returns

(12% market average + 4% fixed gold in grams)

Your gold is leased to top-tier jewellers. Interest calculated daily, credited monthly to your dive account

Start investing in Digi Gold+ with just ₹1500

Curated by professionals with 20+ years of market experience

Diversified. Risk-hedged. Earn up to 29.75% 3-year CAGR

Easy to buy, track and exit

Start investing in Wealth Plans with just ₹1000

Built using 1M+ data points and 20+ years of historical market performance

Aligned to your goals, liquidity needs, and risk profile

Reviewed by our in-house mutual fund experts

Start investing in Personalised Portfolios with just ₹2500

I never thought I’d be someone who invests, but Dive made it really easy. I started buying digital gold every month through the app. It’s simple, safe, and something I can understand. Knowing it’s 24K gold and seeing it grow steadily gives me both peace of mind and a sense of control over my money.

I use Dive to balance things out. I put some money in Digi Gold+ for the steady returns, and the rest in mutual funds that can grow over time. I don’t need to check it every day, it just runs quietly in the background. With everything else I’m juggling, that kind of setup honestly feels like a win.

I started with Dive’s Wealth Plans a few months ago. I invest every month through SIPs and track everything on the app. My portfolio gets automatically diversified, and the fact that real experts pick the funds gives me confidence. The returns have been solid so far, and I’m excited to see how it grows from here.

*Based on historical returns. Dive All Stars portfolio is considered for Wealth Plans.

Security is our priority, because we care.

Regulated & Compliant

Regulated & Compliant Bank-Grade Encryption

Bank-Grade Encryption Powered by UPI

Powered by UPI

Frequently Asked Questions